I suggest that the FairPay revenue model provides a new market regime that reorients the invisible hand toward shared value, one that can be operationalized in business today, to offer an entirely new micro-economics for profit-seeking business transactions.

Porter and Kramer nicely draw the big picture for shared value, noting that, unlike calls for "Corporate Social Responsibility" that are at odds with profit motivations,

Shared value focuses companies on the right kind of profits - profits that create societal benefits rather than diminish them. ...

The moment for an expanded view of value creation has come. A host of factors, such as the growing social awareness of employees and citizens and the increased scarcity of natural resources, will drive unprecedented opportunities to create shared value.

We need a more sophisticated form of capitalism, one imbued with a social purpose.They suggest what we need is not "a redistribution approach," but one for "expanding the total pool of economic and social value.

FairPay takes this CSV big picture and provides methods for "doing business as business" that support that vision. These methods can be applied now, in a wide range of businesses, and will point the way to applying similar new thinking more generally. (FairPay was designed for, and clearly applies now, in markets in which marginal costs are low, such as for digital products or services. Digital markets, especially for content, are widely recognized as being markets in which traditional capitalism has been unable to adapt effectively to the new digital economy, and new business models are urgently needed.)

FairPay turns the force of the invisible hand to span ongoing relationships. It guides pricing to create shared value between customers and businesses over long-term relationships (in which customers have a say in the creation of shared value). It looks beyond one-time transactions, to ongoing dialogs about value.

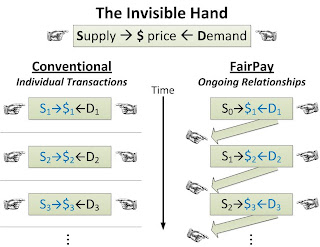

- Adam Smith's invisible hand works at a transaction level: it optimizes the balance of supply and demand in terms of prices for large numbers of individual transactions. Transaction prices drive supply and demand into balance, by shifting supply or demand until balance is achieved. This invisible hand does not know or care about repeat business or shared value (except as it affects demand in aggregate).

- FaiPay turns the invisible hand on its side, to work over time, at the relationship level: it optimizes the balance of supply and demand in terms of prices over time, with respect to individual customers. Relationship pricing is balanced through an ongoing series of pricing conversations, to achieve an agreed upon level of shared value in each of a multitude of ongoing buyer-seller relationships. Shared value is integral to these pricing conversations.

- For each transaction, the buyer is given the full power to set prices based on the value actually received (Fair Pay What You Want). This is done retrospectively, when the value is known to the buyer.

- The seller must accept the buyer's price for that transaction, but the seller holds the power to decide if the buyer's pricing is fair enough to want to extend the relationship by continuing to make FairPay offers for future transactions (considering what has been learned about the buyer's pricing behavior and reasons).

- Buyers have full freedom regarding the pricing of single transactions, but have the incentive to be fair to sellers and divide the shared value surplus in a way that is fair to the seller. They are also invited to give reasons for their pricing that indicate why they think their perception of shared value is more or less than the seller has suggested. Based on guidance from the seller on suggested prices, costs, usage, social norms, and the buyer's reasons, both sides can learn whether and how they can agree over time on criteria for fair pricing that creates the maximum shared value (even if they do not agree on each transaction).

- Sellers yield power over a limited number of individual transactions, but gain new power to truly understand the value they provide to individual sellers in each transaction, and to engage in a substantive dialog with their customers about that value and how they should share in it. Sellers manage the "choice architecture" that frames the value proposition and the factors to be considered, and can signal what buyer pricing behaviors they accept as fair or unfair. The seller learns how loosely or rigidly to manage each customer relationship to create profit and grow its share of the pie.

- FairPay pricing can be used in combination with conventional pricing as a back-stop, and positioned as a privilege offered to those who desire a relationship based on shared value and respect for the obligations of fairness that entails.

- Sellers can manage the "choice architecture" by using premium tiers and perks as rewards, and the threat of withdrawal of such premiums as penalties, to nudge buyers to price at the highest levels the buyers consider justifiable. Sellers also hold the threat of complete withdrawal of future Fairpay privileges (returning an "unfair" buyer to fixed pricing for future transactions) as a powerful incentive to deter abuse.

The essence of Fairpay is that buyers and sellers engage in a continuing individualized dialog about shared value--both at a personal and a social level--as actually realized in every transaction.

- FairPay seeks maximum shared value for each customer, by being specific to the value sought and received by that consumer, at that time, in that context.

- It reflects individual variations in need, value perception, willingness to pay, ability to pay, and all relevant criteria. It provides sellers with fine-grained, in-context "market" data for segments of one, that enable the sellers to fully understand market needs, and learn new ways to meet them, and to delight their customers, one by one.

- It naturally reflects broader considerations of shared social value beyond the individual customer, by sharing responsibility with the customer for the social valuation process. Buyers are free to consider whether a seller is socially responsible in the larger sense, and to factor that into their willingness to pay (to whatever extent they desire). What might have been an externality to the seller may be internalized by the buyer, so that the seller must internalize it as well. Social values shift from external constraints at odds with profit maximization to natural subjects of the value dialog with the buyer.

- It changes the equation from a zero-sum game of buyers shopping around for the lowest prices and sellers seeking to be the low-cost provider, to a win-win collaboration for achieving shared value.

- Instead of consumers seeing profits as coming at their expense, profits are framed as a valid and deserved sharing of their value surplus with a company that is a respected partner in value creation. This gives a new legitimacy to profit-seeking, as integral to collaborative creation of shared value.

Where and when can FairPay fit in? It is most clearly applicable to businesses in which marginal costs are low. A major segment is in markets for digital products and services. Such markets already make extensive use of free trials, freemium models, and even pay what you want promotions. These markets already exploit the low incremental cost of producing additional (marginal) items, to give away some product in order to sell more in the future. FairPay can be introduced immediately, to do this in a much more economically efficient way. Some controlled level of zero-revenue transactions are accepted as a market learning cost, in order to discover what buyers are willing to pay and whether they are good partners. With FairPay, instead of "free" offers, the offers are value-based (but are similarly risk-free to the buyer). Similar immediate opportunities for FairPay arise in markets where physical goods and services are perishable (such as those currently addressed by Priceline's "name your price" model). As businesses and consumers get used to FairPay, opportunities to exploit it will expand.

Turning the invisible hand to the broader aspects of shared value. FairPay naturally guides better economic efficiency, while significantly reflecting the broader context of shared value. When this new turn of the invisible hand gives consumers a say in pricing, social values will be served as just another corporate profit opportunity, not a "Corporate Social Responsibility" cost.

- Price efficiency and legitimacy: FairPay provides a structure for pricing that is dependent on buyer acceptance in a way that legitimizes differential pricing - to efficiently address varying value perceptions, usage patterns, and abilities to pay. Price "discrimination" becomes an equitable method for maximizing shared value when the buyer participates in the discrimination and accepts the rationale for paying more or less than other buyers. This can enable usage-based and other value-based pricing in ways that buyers can agree to and temper as desired (such as paying little extra for an unintended and atypical overage in usage). Many current markets are very inefficient because of consumer aversion to metering and other rate discrimination. "All you can eat" pricing plans have popular appeal to narrow customer interests, but their wastefulness and inequity will become very apparent when customers participate in pricing decisions.

- Disadvantaged markets: This buyer acceptance of "fair and reasonable price discrimination " also enables new ways to efficiently address low-income and disadvantaged markets at a profit (and social benefit). For example, it becomes clear that those who can afford to pay more than others should do so. Information and digital services that may expensive in high-value/high-ability-to-pay markets can fairly be offered far more cheaply in disadvantaged markets without cannibalizing the markets where buyers know they can and should fairly share their large value surplus. When treated as partners in shared value pricing decisions, consumers will recognize that companies should be able to profit more (and recover more of their costs) from those who can afford it than from those who cannot, and companies will be able to expand and differentiate their markets accordingly.

- Innovation and productivity: FairPay's individual dialogs about value give companies both the incentive and the market information needed to innovate to better serve existing and potential customers, and to communicate how they offer value to different customers. FairPay pricing dialogs will capture rich and detailed transaction level data on individual buyer value perceptions, needs, and desires. They can re-conceive products and markets, identify new needs, create efficiency, and expand markets, in a natural partnership with their customers.

From there we can learn how extend the principals underlying FairPay to other markets, and perhaps develop similar models of relationships and of dialog about value that can work even for products and services where marginal costs are not low. We will enter a new era in capitalism as a way to collaboratively create shared value, guided by a new and broader sweep of the invisible hand.

Aivivu - đại lý chuyên vé máy bay trong nước và quốc tế

ReplyDeletevé máy bay đi Mỹ giá rẻ 2021

giá vé máy bay từ mỹ về việt nam tháng 12

vé máy bay từ nhật về vn

khi nào có chuyến bay từ đức về việt nam

lịch bay từ canada về việt nam

Có chuyến bay từ Hàn Quốc về Việt Nam không

chi phí vé máy bay cho chuyên gia nước ngoài

Great article! Lansdowne truly is a hidden gem in Uttarakhand. If anyone’s looking for the best room to stay in Lansdowne, I highly recommend checking out Rio Resort. Nestled by the riverside and surrounded by lush greenery, it offers peaceful vibes, cozy cottages, and amazing views—perfect for a relaxing getaway in the hills!

ReplyDeleteFor More Information Contact Us: rioresort.club

Nice! This concept of shifting from the traditional 'invisible hand' toward a model that emphasizes shared, human-centered value resonates profoundly—especially in the context of our digital economy. https://www.yourconcretecompanytx.com/

ReplyDelete